Labor variance has a direct and often profound impact on a company’s financial statements, influencing both the income statement and the balance sheet. When labor costs deviate from the standards set during budgeting, these variances are reflected in the cost of goods sold (COGS) on the income statement. Unfavorable labor variances increase COGS, thereby reducing gross profit and, ultimately, net income. This can signal inefficiencies to stakeholders and may affect investor confidence. United Airlines asked abankruptcy court to allow a one-time 4 percent pay cut for pilots,flight attendants, mechanics, flight controllers, and ticketagents. The pay cut was proposed to last as long as the companyremained in bankruptcy and was expected to provide savings ofapproximately $620,000,000.

Paid-In Capital vs Retained Earnings: Differences and Financial Impact

Tools like Tableau or Power BI can be instrumental in visualizing these variances, making it easier for managers to identify patterns and take corrective actions. Effective leadership can optimize labor performance by setting clear expectations, providing timely feedback, and fostering a positive work environment. Poor management, on the other hand, can lead to miscommunication, low morale, and inefficiencies, all of which contribute to conversion cost definition formula example. Implementing robust management practices and leadership training programs can therefore play a crucial role in minimizing labor variances.

Do you already work with a financial advisor?

Direct Labor Mix Variance is the difference between the budgeted labor mix and the actual labor mix used in production, which can lead to an over- or under-utilization of resources. Figure 10.7 contains some possible explanations for the laborrate variance (left panel) and labor efficiency variance (rightpanel). Another strategy involves continuous improvement initiatives such as Lean and Six Sigma. These methodologies focus on streamlining processes and eliminating waste, thereby improving labor efficiency. For example, Lean techniques can help identify bottlenecks in production that cause delays, while Six Sigma can provide a data-driven approach to reducing errors and rework.

What is direct labor yield variance?

After filing for Chapter 11 bankruptcy inDecember 2002, United cut close to $5,000,000,000in annual expenditures. As a result of these cost cuts, United wasable to emerge from bankruptcy in 2006. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Why is it important to calculate direct labor yield variance?

- Connie’s Candy paid \(\$1.50\) per hour more for labor than expected and used \(0.10\) hours more than expected to make one box of candy.

- Direct Labor Mix Variance typically occurs when the actual labor mix used in production is different from what was budgeted or anticipated.

- Predictive analytics is another powerful tool for managing labor variance.

- Another strategy involves continuous improvement initiatives such as Lean and Six Sigma.

- The labor variance can be used in any part of a business, as long as there is some compensation expense to be compared to a standard amount.

How would this unforeseen pay cutaffect United’s direct labor rate variance? Thedirect labor rate variance would likely be favorable, perhapstotaling close to $620,000,000, depending on how much of thesesavings management anticipated when the budget was firstestablished. Beyond the income statement, labor variances also affect the balance sheet. For instance, unfavorable variances can lead to higher accounts payable if additional labor costs are incurred but not yet paid. This can strain cash flow and liquidity, making it more challenging for the company to meet its short-term obligations.

Labor variance is shaped by a multitude of factors, each contributing to the complexity of managing labor costs effectively. Highly skilled employees tend to perform tasks more efficiently and with fewer errors, leading to favorable labor variances. Conversely, a less experienced workforce may require more time and supervision, resulting in unfavorable variances. Investing in continuous training and development can help mitigate these discrepancies by enhancing employee competencies. Favorable when the actual labor cost per hour is lower than standard rate. On the other hand, unfavorable mean the actual labor cost is higher than expected.

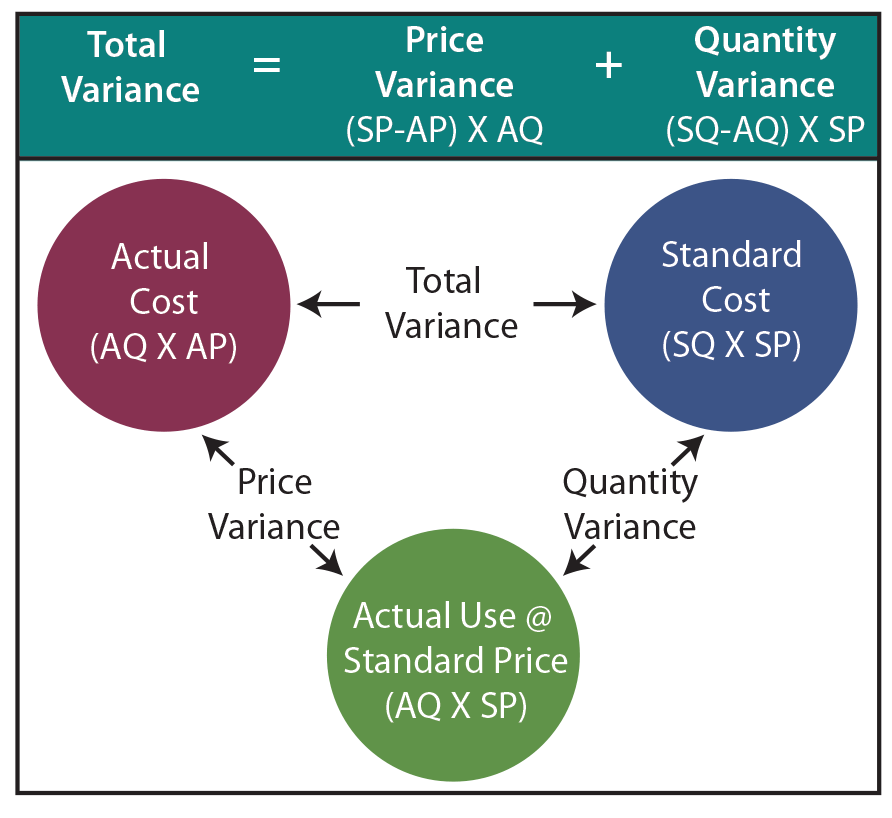

Calculating labor variance involves a nuanced understanding of both the theoretical and practical aspects of labor cost management. The process begins with establishing standard labor costs, which are derived from historical data, industry benchmarks, and internal performance metrics. These standards serve as a baseline against which actual labor costs are measured. By comparing these two sets of data, companies can identify variances that highlight areas needing attention. Another significant component is labor efficiency variance, which measures the difference between the expected hours of labor required to produce a certain level of output and the actual hours worked. This variance can be influenced by factors such as employee productivity, the effectiveness of training programs, and the efficiency of production processes.

The labor efficiency variance calculation presented previouslyshows that 18,900 in actual hours worked is lower than the 21,000budgeted hours. Clearly, this is favorable since theactual hours worked was lower than the expected (budgeted)hours. The 21,000 standard hours are the hours allowed given actualproduction. For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production. Thus the 21,000 standard hours(SH) is 0.10 hours per unit × 210,000 units produced.

In this case, two elements are contributing to the unfavorable outcome. Connie’s Candy paid \(\$1.50\) per hour more for labor than expected and used \(0.10\) hours more than expected to make one box of candy. The same calculation is shown as follows using the outcomes of the direct labor rate and time variances.

Labor efficiency variance downplays the influence of external factors on labor analysis because it uses a standard hourly rate as part of its calculation. A production department may have little ability to control external factors, so labor efficiency variance is an ideal way to analyze changes to labor usage based on factors the department can control. In theory, maximizing production efficiency takes care of itself in the larger picture of overall profitability. In practice, each company can devise its own standard hourly rate, which may not reflect labor levels beyond the scope of internal efficiency. Labor rate variance is the difference between actual cost of direct labor and its standard cost. The difference due to actual amount paid and the standard rate per hour while the time spends during production remains the same.