As discussed above, Medicare was historically a cost-based reimbursement scheme. In process costing, all of the processing departments are classified as operating departments. Other departments, called service departments are needed for the business to operate, but do not directly engage top 5 legal accounting software for modern law firms in operating processes. Service departments include accounting, human resources and purchasing. These departments all provide services to each of the operating departments. The three alternative methods of allocating service department costs to users are summarized in Exhibit 6-13.

Direct Method of Cost Allocation: Example, Calculation

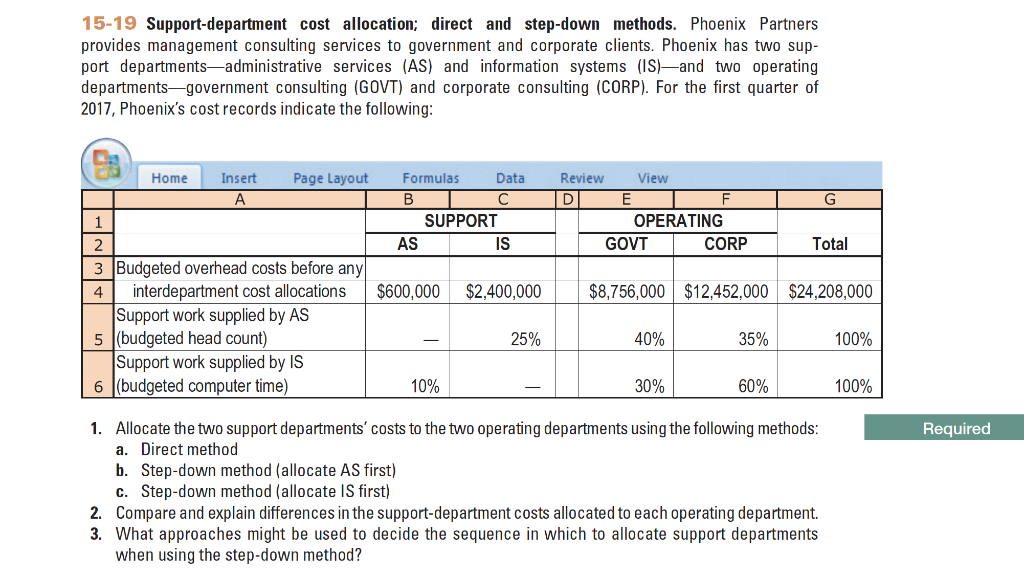

Therefore, the joint cost allocations should not imply that trueprofitability has been obtained. Critics rebut the previous argument by pointing out that this method sometimes produces a negative cost allocation to some ofthe less profitable products (See the example below). Certainly, approximations of the true costs are better than these confusing cross-subsidies. The plant wide rates provide inaccurate product costs because the products do not consume the indirect resources in the same proportions in each of the two departments. The step-down, or sequential method, ignores self services, but allows for a partial recognition of reciprocal services. As a result, the step-down method is different from thedirect method in that some service department costs are allocated to other service departments.

How confident are you in your long term financial plan?

Despite the concerns just noted, many organizations employ the step allocation method. The step-down method starts by identifying the primary cost center, often the one with no services received from other centers. The center allocates its costs to different cost centers based on a predetermined allocation basis, such as direct labor hours or machine hours. It allocates the costs of the primary cost center and then moves on to the next cost center, taking into account the costs already allocated to it. This sequential process continues until all cost centers have received their allocated costs.

Cost allocation methods

However, a new public utility has recently offered to provide electric power to the plant for 4.5 cents per kilowatt hour. As a result the firm’s management needs to know how much cost could be avoided if the electric power plant were closed, and how much electricity would be needed if it were purchased externally. The company used three million kilowatt hours of electricity during the previous period. A third method, referred to as activity based product costing, also involves a two stage allocation process where the first stage is essentially the same as in thetraditional two stage approach. However, in the second stage of the ABC approach, overhead costs are separated into cost pools so that different typesof costs can be traced to products more accurately using different types of activity measures.

- This method is particularly suitable for organizations with a clear hierarchical structure, where some cost centers provide services to others.

- This method allows for a more refined and precise allocation of costs, ensuring that each profit center and product bears an appropriate share of the overall expenses.

- As can be seen by adding $105,522 and $134,478, all $240,000 incurred by the service departments are ultimately allocated to the two production departments.

- Revised income statements are presented in Exhibit 6-19 to underscore this point.

- Describe several types of supporting logic for cost allocations methods including the concepts of “cause and effect”, “ability to bear” and “fairness andequity”.

Compare dual rate and single rate methods for stage I cost allocations.8. Solve cost allocations problems using the dual rate and single rate methods.9. Discuss the cost distortions that tend to occur when a plant wide overhead rate is used.10.

Get in Touch With a Financial Advisor

Some observers say this is fair, while othersvoice the opposite viewpoint. Gasoline taxes, on the other hand, are regressive in that those with lower incomes pay a larger percentage of their incomes thanthose with higher incomes for an equal quantity of gasoline. Using the “ability to bear”, or percentage of income perspective, gasoline taxesappear to be unfair to low income drivers. However, using the “benefits received” perspective, gasoline taxes appear to be fair. Kenneth W. Boyd has 30 years of experience in accounting and financial services. He is a four-time Dummies book author, a blogger, and a video host on accounting and finance topics.

These dynamic expenses respond to factors like production volume, supply chain shifts, and market prices. When raw material costs spike, manufacturing expenses increase accordingly. Similarly, packaging costs and shipping fees vary with sales volume—more orders mean higher delivery expenses. While most variable costs directly link to production, some, like utility bills, fall into an indirect category. Your electricity usage might surge during peak production periods or vary with seasonal changes, making it a variable cost that affects the whole operation. The reason for this high usage level is that this approach is clear and easy to use, and can be completed within a relatively short period of time.

Inthe traditional approach, the activity measures, or allocation bases, are almost always related to production volume (like the four mentioned in the previoussentence). If Product Xconsumes 20 percent of one indirect resource within a department, it must consume 20 percent of all of the indirect resources within the department andthe allocation basis must reflect this percentage. Otherwise a single departmental rate will not provide accurate product costs. The General Products Company is a manufacturing firm with six service departments and five producing departments. Many of the service departments serve each other in addition to providing service to the producing departments. The various departments and applicable variable direct cost, (i.e., the cost identified with these departments before reciprocal service cost allocations) are presented in Table 1 for the most recent accounting period.

In such settings, the calculation of cost includes a reasonable allocation of overhead, including overhead from service departments. In the step method, we typically begin with the highest service cost first. We will start with Maintenance and allocate the cost to all remaining operating AND service departments (administration, operating dept 1 and operating dept 2). When calculating the allocation rate, we never use the service department cost driver itself (so do not use the maintenance machine hours used). For example, fixed costs might be allocated based on an estimate of long-term usage by the production departments. Remember, the step method recognizes a one-way relationship between service departments and once the service department cost has been allocated out to other departments, we do not go back and give additional costs to that department.

The notes to the table show how the overhead rates werecalculated in each case. The second method of allocating service department costs is the step method. This method allocates service costs to the operating departments and other service departments in a sequential process. The sequence of allocation generally starts with the service department that has incurred the greatest costs. After this department’s costs have been allocated, the service department with the next highest costs has its costs allocated, and so forth until the service department with the lowest costs has had its costs allocated.

Another possible alternative is not to allocate the joint costs. We can also fill in the original equations for the service departments to find the reciprocal transfers. Although the specific amounts of the reciprocal transfers are not needed tocomplete the allocations to the producing departments, they are needed so that entries can be made to record the transfers between the service departments. There are two main ways to allocate these service costs to the operating departments to make sure we are including all of the costs when we price our products.